A Better Way to Handle SAP Custom Code

Are you upgrading your SAP systems? Are you overwhelmed by the time and effort it takes to address your custom code? Do you know how to make sure everything works before, during, and after a transformation? smartShift can help. Our solutions deliver guaranteed results with fixed timelines, fixed costs, and 100% compatibility.

Industry-Leading Intelligent Automation For SAP Transformations

01

Implement an Intelligent, Data-Driven Approach

At the push of a button, our patented technology uncovers every single issue in your code and fixes 100% of required changes.

02

Transform Without Business Disruption

Our automation synchronizes production and project landscapes so you can keep business moving during even the most complex transformations.

03

Reimagine What’s Possible For SAP Modernization

Our automation analyzes your custom code to identify which programs are candidates for transformation and which will work with a “Clean Core” SAP system.

The Problem With Conventional SAP Custom Code Upgrades

They’re Complex

Most SAP systems have millions of lines of custom code that require manual labor to analyze every change.

We Simplify Them

Our AI-driven solutions analyze 100% of custom code to meticulously evaluate each modification.

They’re Risky

Some manual efforts only fix the high-priority issues, leaving a lot of legacy code untouched and unsafe.

We De-Risk Them

We fix 100% of identified compatibility issues with 99.99% precision to ensure everything works at go-live.

They’re Labor-Intensive

Conventional upgrades require substantial developer resources, which are already scarce and expensive.

We Automate Them

With 100,000+ hours of built-in knowledge, our AI significantly limits human involvement and frees your developers to innovate.

They’re Time-Consuming

Traditional code remediation can take months — even years — of your team’s time and money.

We Accelerate Them

We can analyze and transform all of your custom code in as little as 3 weeks for a fixed price.

Traditional Approach

Development Time

24,000 Hours

0 Hours

100% Reduction

Project Timeline

8 Months

3-6 Weeks

4X Faster

Testing Effort

12 Weeks

2-3 Weeks

75% Reduction

Issue Coverage

30-70%

100%

Future Proof

smartShift Intelligent Automation®: A Simpler Approach to SAP Custom Code

smartShift Intelligent Automation addresses all of your legacy code challenges to eliminate thousands of hours of manual development work and the risk of complications in production — giving your team the time and resources to focus on driving the business forward instead.

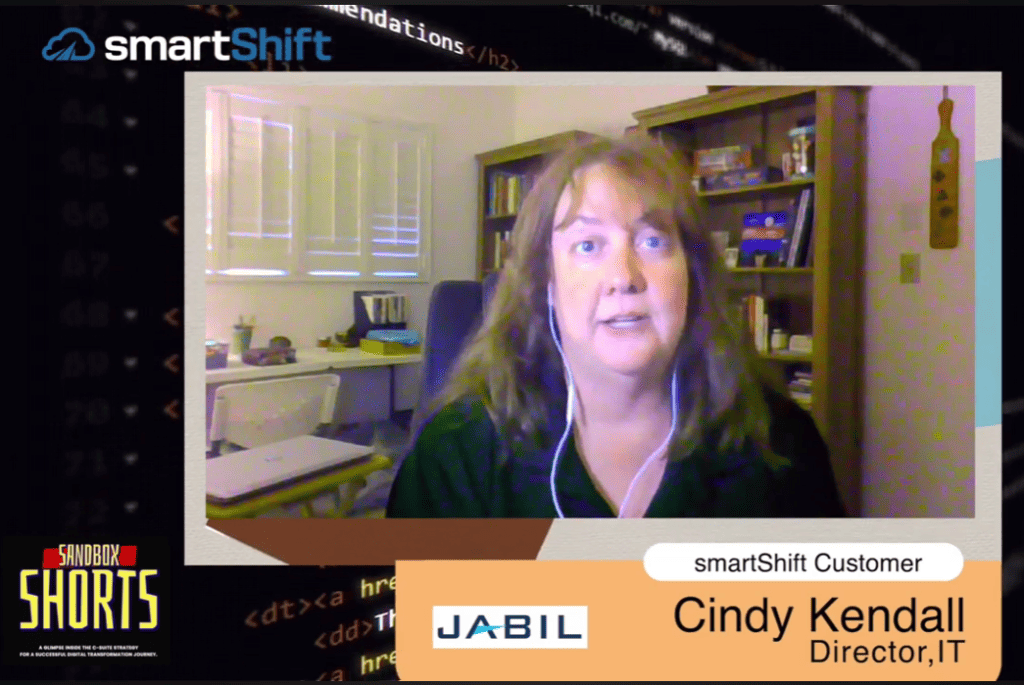

Trusted By Some of The World’s Largest SAP Customers